The United States’ imposition of 25% “reciprocal tariffs” on Indian exports has rattled industries across the board, with India’s dairy sector facing a particularly critical moment. The decision follows the breakdown of bilateral trade agreement (BTA) talks, with India refusing to open its dairy and agricultural markets to heavily subsidised US agri-business.

While New Delhi had anticipated retaliatory measures before President Donald Trump’s August 1 deadline, the timing could not have been worse for Indian dairy exporters, who were seeing encouraging momentum in the US market.

Dairy Exports: A Growing Market Under Threat

India’s dairy and poultry product exports grew 12.6% in FY 2024–25 to reach nearly US$ 5.1 billion, contributing to an overall 6.47% rise in agricultural exports to US$ 51.9 billion.

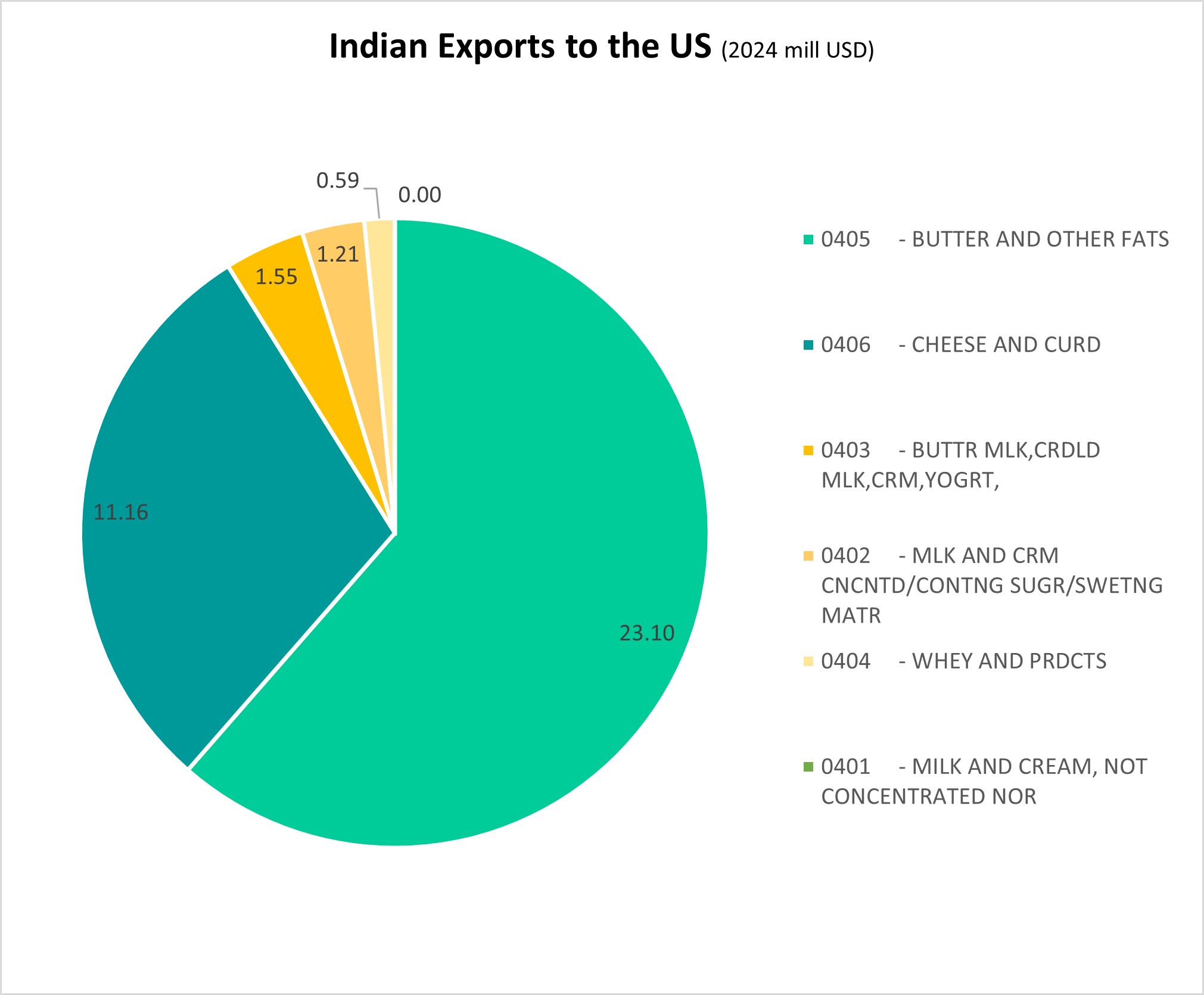

The US emerged as India’s largest dairy export destination in 2023–24, importing roughly 94,000 tonnes of dairy products valued at US$ 180 million, including ghee, milk powder, casein, and other specialty dairy products. This growth was expected to continue into 2025, driven by diaspora demand and rising interest in functional dairy products such as probiotic yoghurts and ethnic cheeses.

However, with tariffs now in place, exporters face an effective duty burden of 30–40%, according to Global Trade Research Initiative (GTRI) estimates. This sharp increase could make Indian dairy products uncompetitive in the price-sensitive US market.

Why India Refuses to Open Its Dairy Market

The US tariffs stem from India’s firm refusal to allow access to its dairy sector. Nearly 99.5% of Indian farmers are small or marginal producers, as per India’s WTO submissions, and would be unable to compete with the economies of scale enjoyed by large US corporations.

US farm subsidies—among the highest globally—were pegged at US$21666 billion in 2022, enabling American exporters to sell products at artificially low prices, a practice widely regarded as dumping.

This stance echoes historical lessons from the PL-480 food grain programme during the 1965 India-Pakistan conflict, where dependency on US imports became a political vulnerability. Since then, self-sufficiency in food and dairy production has remained a cornerstone of Indian policy.

🌍 Diversification is the Only Path Forward

India’s dairy sector is at a strategic inflexion point. With milk production projected to reach 216.5 million metric tonnes (MMT) in 2025 (up from 211.7 MMT in 2024), India remains the world’s largest producer. Yet, only a small percentage of this output is exported, making the sector highly sensitive to trade disruptions.

Global South markets—particularly Southeast Asia, the Middle East, and Africa—are emerging as promising destinations for Indian dairy products, from butter and skimmed milk powder (SMP) to value-added ethnic products.

“Relying too heavily on the US market is risky,” Mehra added. “South-South partnerships provide cultural acceptance, political stability, and lower trade barriers—exactly what Indian exporters need now.”

Key Data Snapshot (FY 2024–25)

| Metric | Value |

|---|---|

| Dairy & poultry exports | US$5.1 billion (+12.6%) |

| India–US dairy trade | 94,000 tonnes; US$ 180 m |

| Butter exports (forecast) | 0.06 MMT (2025) |

| Fluid milk exports (forecast) | 0.03 MMT (2025) |

| Total milk production | 216.5 MMT (+3% YoY) |

Strategic Takeaways for the Dairy Sector

- Short-term pain: Tariffs will hit margins and potentially slow down the double-digit export growth trajectory.

- Domestic protection remains vital: Opening up to subsidised US dairy imports would devastate smallholder farmers and cooperatives.

- Diversification is key: Expanding into Global South economies can cushion the sector from the volatility of US-centric trade policies.

The Trump administration’s unilateral “America First” approach may have created fresh challenges, but it also underscores the importance of resilient export strategies. India’s dairy sector—already a global powerhouse in production—must now double down on market diversification to secure its long-term growth.